Lawrence Sanders & Sean P. Sanders

The internet changed the world forever through disintermediation. The internet improved supply chain efficiency through disintermediation. So did open source software, Wi-Fi, cell phones, 3d printing, ubersation, DVRs, Napster and MP3 compression, GPS applications, and of course microprocessors. Now the internet of things (IoT), driverless cars, artificial intelligence and blockchain distributed ledger applications will carry on that tradition.

Disintermediation is the reduction of intermediaries (such as wholesalers and middleman) between producers and consumers. Disintermediation allows consumers to buy stocks without consulting a broker and buy directly from the manufacturer and to avoid wholesalers and brick and mortar stores. Too many consumers and businesses, the internet was emancipatory. Wholesalers, supply chain entities, and financial institutions were perceived as being detrimental to business objectives, profitability, and lower prices. And yes, productivity did indeed increase, with the greatest gains in productivity climaxing in the late 1990s (R.J. Gordon 2012)

Consumers do not have to buy at a local store or use a travel agent. They go directly to Amazon, to Expedia, and Apple to purchase products directly, without intermediaries. These new-age companies are ruthless in their commitment to owning the supply chain ( Amit Bhalya). Amazon is the poster-child company epitomizing disintermediation. But, not for long; if the emerging blockchain and cryptocurrency intermediaries have their way

The blockchain and cryptocurrency entrepreneurs want to eliminate Amazon, Google, and Apple. They also want to eliminate super-sized intermediaries such as credit card companies, financial institutions, and government agencies.

“We’re all ideologically aligned to crush Amazon and other centralized services” Blockchain Entrepreneurs Target Apple and Google at Token Summit

Yes, and replace them with themselves. The new-new-age intermediaries will be the cryptocurrency and blockchain companies. They want to emancipate consumers and businesses from the clutches of the dotcom elites. There is a proposed blockchain application for virtually every existing legacy applications, and there is probably an initial coin offering to pay for it (www.icoalert.com ).

Lock-In

Lock-in occurs when there are switching costs involved in switching from one product to another product (Shapiro and Varian 1999). There are switching costs when you move to new operating systems, tax software, mobile carrier, or loyalty program. Sometimes the switching costs are contractual. For example, cable television broadband providers and wireless phone providers have penalties for customers who terminate a contract early. Switching costs can involve time and psychological effort (Sanders and Huefner 2011). When you switch cable providers or get a new router, there is a learning curve related to using the new station guide, digital video-recording and setting up the router and connecting the devices to the router.

The goal of producers is to lock-in their customers and lock-out the competition using switching costs. High switching costs make it difficult for customers to go elsewhere. Figure 1 illustrates the degree of lock-in related to various technologies and businesses.

People shop at Amazon because the interface is easy to use, Amazon has competitive prices for millions of products, they store a ton of personal information on family and friends, and fulfillment is a snap. People buy from Expedia for the same reasons. The same goes for tax software.

There are many downsides to being locked-in, but one particularly problematic area is that businesses that lock-in customers sometimes abandon innovation. The outcome is that companies eschew innovation and let their products and service languish in mediocrity.

Figure 1: Levels of Lock-In for Businesses and Technologies

How Lock-In Relates to Blockchain Applications

A block in a blockchain is a decentralized ledger where transactions, such as cryptocurrency transactions, are added as they occur (see Figure 2). Because the ledger is immutable, transactions cannot be changed. The blockchain software will not permit transaction updates. Once a transaction is posted, it is there forever.

The net result of this immutability is that blockchain-based applications lock-in the data forever. Immutability is the strength and the Achilles heel of blockchain applications. The process of forking is the only way to correct major problems with the blockchain infrastructure. A fork spits the blockchain into two separate chains.

Simple problems with invalid transactions, you sent your private key to yourself and someone stole it, or mistakes, you sent 10,000 coins to the wrong person, are difficult if not impossible to fix. So if there is a high-school picture of you in a blockchain-based photo repository, it will be there for generations to view. You are locked-in forever.

Figure 2: Mining Process

Lock-In is not Agile Friendly

Immutable systems go against the grain of the agile manifesto and agile software development. It is contrary to the spirit of agile innovation. Agile software development is an iterative and incremental development approach where requirements evolve, and the focus is on the customer. The interfaces evolve, the data structures evolve, and the solution evolves. You can use agile techniques in the initial design for a block-chain based application, but once the launch takes place, the evolution and innovation stops. Patching major holes in the system after launching is difficult. If a fork or major change in the blockchain is required, then there is a battle royal.

The founders, the developers, the miners, and even the manufactures of the miner hardware are the new intermediaries and the owners. The founders and developers receive a substantial portion (20-30%) of the pool of tokens and coins. Satoshi has about 1 million coins, worth over $10 billion at $10,000 per Bitcoin, and we do not even know who he or she is. Even non-profits hold tokens for employees and future projects. See, for example, the Root Project.

Recommendations for Blockchain

Blockchain technology, like all promising technologies, has desirable features and deficiencies. Theoretically, blockchain technologies and distributed ledgers should improve the integrity, tracking, security, and longevity of transactions for digital content, personal information, organizational assets, and the “real world.” Here are some suggestions for individuals and companies considering investing in blockchain and distributed ledger technologies.

Large Companies

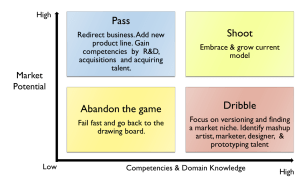

Large companies should begin testbed applications of blockchain technology by developing prototypes of blockchain applications. Employees from various organizational functions should attend conferences, watch videos, talk to vendors, search for additional information on the technology and develop a brief report on the market potential for the industry. If blockchain technology looks promising, then start building an application that complements the business.

Don’t’ be worried about first-mover-advantage. That train has already left, and you are better drawing on the work of successful and unsuccessful investors in the technology.

Small Companies

Small companies should also monitor blockchain technology and have someone report on an ongoing basis on the emergence of viable platforms for adopting the technology. The best strategy is to wait until an Amazon for blockchain arrives (ABS). It may even be Amazon. Amazon has purportedly registered amazonthereum.com, amazoncryptocurreny.com, and amazoncryptocurrencies.com.

Individuals

Individuals should just read about the technology and keep up to date. You might buy a small amount of amount of cryptocurrency and try to purchase something with it. Don’t spend more than 1% of your annual income. This is a great way to learn about the technology and watch how a digital currency transaction unfolds. It is a great learning tool.

Stay away from launching your own ICO or initial coin offering. Many of the ICOs will fail, some of ICOs are scams, and in some instances they have the undesirable potential to compromise your credibility. You can’t believe much you read about the industry, but here is a study that claims 81% of ICOs are scams, 6% failed, 5% dead, and 8% went on to trade.

Finally, resist buying a Bitmain Antminer S9 and start digital currency mining. You will not make enough money to cover electricity costs. Above all, don’t connect a long extension cord to your next door neighbor’s outdoor outlet to run a mining rig.

If you want a simple and insightful overview of cryptocurrencies and blockchain check out John Oliver video produced by HBO. Be warned, some of the language used is explicit, NSFW and not for kids.

Additional References

- Professor Bina Ramamurthy is offering several local and online blockchain and cryptocurrency courses in The Blockchain ThinkLab.

- Blockchain Technology Overview from U.S. Department of Commerce, January 2018

- Seven Unexpected Blockchain Uses That Will Improve Business, January 31 Forbes article

- This is a nice technical book: Mastering Bitcoin: Programming the Open Blockchain by Andreas M. Antonopoulos January 31 Forbes article

- This is a good overview of the blockchain validation process.

- If you are interested in a simulation illustrating the computationally intensive aspects of using hashes and nonces in proof of work, then go here and click on My Hash Program.

- Sanders, G. L. and R. J. Huefner (2011). Developing new products and services: learning, differentiation, and innovation. New York, Business Expert Press.

- Shapiro, C. and H. R. Varian (1999). Information rules: a strategic guide to the network economy. Boston, Mass., Harvard Business School Press.